All Categories

Featured

Table of Contents

For lots of people, the largest trouble with the infinite financial idea is that first hit to early liquidity triggered by the costs. Although this disadvantage of unlimited banking can be reduced considerably with proper plan style, the initial years will certainly constantly be the worst years with any Whole Life policy.

That said, there are certain boundless financial life insurance policy plans designed mainly for high very early cash value (HECV) of over 90% in the first year. Nonetheless, the long-term performance will certainly commonly significantly delay the best-performing Infinite Financial life insurance policy plans. Having accessibility to that extra 4 numbers in the initial couple of years might come with the expense of 6-figures in the future.

You in fact get some substantial lasting benefits that help you recover these very early costs and then some. We find that this hindered very early liquidity problem with limitless financial is extra psychological than anything else once completely discovered. If they definitely required every cent of the cash missing from their infinite financial life insurance policy in the very first couple of years.

Tag: boundless financial idea In this episode, I chat regarding financial resources with Mary Jo Irmen who teaches the Infinite Banking Principle. With the increase of TikTok as an information-sharing platform, financial suggestions and techniques have discovered a novel means of spreading. One such approach that has actually been making the rounds is the infinite financial idea, or IBC for short, amassing recommendations from celebs like rap artist Waka Flocka Fire.

Within these plans, the cash money worth grows based on a price set by the insurance provider. As soon as a significant cash money value collects, policyholders can obtain a cash value funding. These fundings differ from traditional ones, with life insurance policy offering as security, suggesting one might shed their insurance coverage if loaning exceedingly without ample cash money worth to support the insurance expenses.

And while the appeal of these policies appears, there are inherent constraints and threats, demanding attentive cash money value surveillance. The approach's legitimacy isn't black and white. For high-net-worth individuals or local business owner, specifically those utilizing techniques like company-owned life insurance policy (COLI), the advantages of tax obligation breaks and compound growth could be appealing.

Using Life Insurance As A Bank

The attraction of unlimited financial does not negate its difficulties: Cost: The foundational requirement, a long-term life insurance policy plan, is costlier than its term counterparts. Qualification: Not everyone gets whole life insurance policy due to rigorous underwriting procedures that can leave out those with certain health and wellness or way of living problems. Complexity and danger: The detailed nature of IBC, coupled with its risks, might hinder many, especially when less complex and less dangerous choices are readily available.

Assigning around 10% of your month-to-month revenue to the plan is just not viable for the majority of people. Using life insurance policy as a financial investment and liquidity resource calls for discipline and surveillance of policy cash worth. Consult an economic expert to establish if unlimited financial lines up with your concerns. Component of what you check out below is simply a reiteration of what has currently been said above.

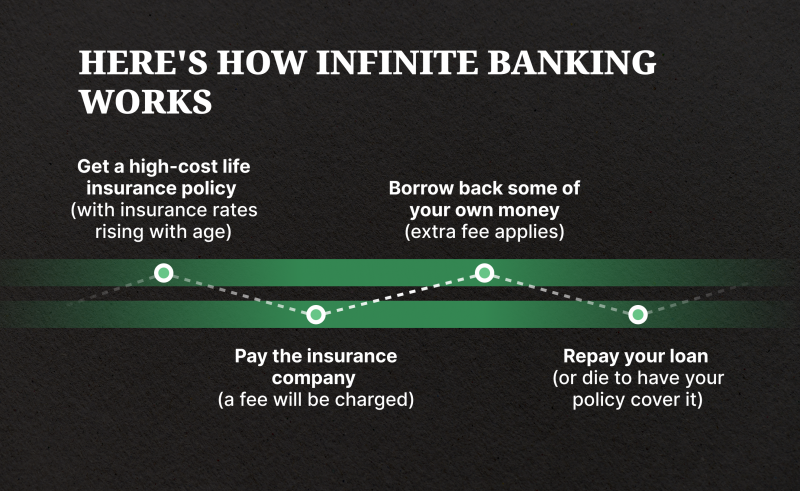

Prior to you obtain on your own right into a scenario you're not prepared for, know the adhering to first: Although the idea is typically offered as such, you're not actually taking a funding from on your own. If that held true, you wouldn't have to repay it. Instead, you're borrowing from the insurer and have to repay it with rate of interest.

Some social media posts advise utilizing money worth from entire life insurance policy to pay for charge card financial debt. The concept is that when you repay the finance with interest, the quantity will certainly be returned to your financial investments. However, that's not how it works. When you repay the car loan, a section of that passion mosts likely to the insurer.

For the first a number of years, you'll be paying off the payment. This makes it extremely difficult for your policy to collect value throughout this time. Unless you can manage to pay a couple of to a number of hundred dollars for the next years or even more, IBC will not work for you.

Infinite Banking Course

Not every person ought to count only on themselves for financial safety. If you require life insurance coverage, right here are some important ideas to take into consideration: Consider term life insurance policy. These policies supply coverage throughout years with substantial financial obligations, like mortgages, trainee car loans, or when looking after young kids. Make certain to search for the very best rate.

Copyright (c) 2023, Intercom, Inc. () with Reserved Font Call "Montserrat". Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Scheduled Font Style Name "Montserrat".

Bank On Yourself Review Feedback

As a CPA specializing in property investing, I have actually cleaned shoulders with the "Infinite Banking Concept" (IBC) extra times than I can count. I have actually even talked to experts on the topic. The major draw, besides the evident life insurance policy advantages, was constantly the idea of accumulating money worth within a permanent life insurance policy policy and borrowing against it.

Sure, that makes good sense. Yet honestly, I always believed that money would certainly be much better spent straight on investments instead of funneling it via a life insurance policy policy Up until I uncovered how IBC could be integrated with an Irrevocable Life Insurance Policy Count On (ILIT) to produce generational riches. Let's start with the basics.

What Is A Cash Flow Banking System

When you borrow against your policy's cash value, there's no collection payment schedule, providing you the freedom to take care of the funding on your terms. Meanwhile, the cash money worth remains to grow based on the plan's assurances and dividends. This configuration enables you to access liquidity without interrupting the long-lasting growth of your policy, supplied that the funding and rate of interest are handled sensibly.

As grandchildren are born and expand up, the ILIT can purchase life insurance coverage policies on their lives. Household members can take financings from the ILIT, utilizing the cash money worth of the plans to fund investments, start businesses, or cover major expenses.

A crucial facet of managing this Family members Bank is using the HEMS criterion, which represents "Health and wellness, Education, Upkeep, or Support." This standard is typically consisted of in count on contracts to guide the trustee on just how they can distribute funds to recipients. By adhering to the HEMS requirement, the trust fund guarantees that distributions are produced vital demands and long-lasting support, securing the count on's possessions while still offering member of the family.

Boosted Flexibility: Unlike stiff small business loan, you regulate the payment terms when borrowing from your own plan. This allows you to framework payments in such a way that straightens with your business cash money circulation. infinite bank glitch borderlands 2. Enhanced Cash Money Circulation: By financing overhead with plan fundings, you can potentially maximize cash that would certainly otherwise be connected up in traditional loan settlements or tools leases

He has the exact same equipment, but has actually additionally developed added cash value in his plan and obtained tax benefits. Plus, he now has $50,000 readily available in his policy to make use of for future opportunities or expenses. Despite its prospective advantages, some people stay doubtful of the Infinite Banking Concept. Let's resolve a few usual problems: "Isn't this simply costly life insurance?" While it's real that the premiums for a correctly structured entire life plan might be more than term insurance policy, it is necessary to see it as even more than simply life insurance policy.

Infinite Banking Wikipedia

It's about producing a flexible financing system that gives you control and supplies several benefits. When used strategically, it can complement various other investments and service strategies. If you're captivated by the capacity of the Infinite Banking Idea for your organization, here are some steps to think about: Inform Yourself: Dive much deeper into the principle via trusted publications, seminars, or consultations with educated experts.

Table of Contents

Latest Posts

Your Own Bank

Infinite Banking Simplified

Be Your Own Banker Concept

More

Latest Posts

Your Own Bank

Infinite Banking Simplified

Be Your Own Banker Concept